Financial Planning for Evening College Students: Scholarships and Aid at Surana Evening College

Financing your education can be a significant concern, especially when balancing work and study. At Surana Evening College, we are committed to helping our students navigate the complexities of financial planning. Whether you are pursuing a BCom or BCA degree, here are some key strategies and resources to ensure you can manage your educational expenses effectively.

Understanding Financial Aid

Financial aid is a broad term that includes various forms of monetary assistance to help cover college costs. This can include scholarships, grants, and loans. Each type of aid has different criteria and benefits:

Scholarships: These are merit-based awards that do not need to be repaid. They are often granted based on academic performance, talents, or other achievements.

Grants: Typically need-based, grants also do not require repayment and are awarded based on your financial situation.

Loans: These must be repaid with interest after you graduate or leave school. Federal loans generally offer lower interest rates and more flexible repayment options compared to private loans.

Applying for Financial Aid

To apply for financial aid, you will need to complete the necessary applications such as the Free Application for Federal Student Aid (FAFSA). This application collects your demographic and financial information to determine your eligibility for federal and state aid, as well as institutional aid from the college itself.

Steps to Apply for Financial Aid

Complete the FAFSA: This is the primary form used by colleges to assess your financial need. It is essential to fill it out as early as possible to maximize your aid opportunities.

CSS Profile: Some colleges require this additional form, which provides a more detailed financial picture.

Institutional Forms: Check with Surana Evening College’s financial aid office for any additional forms required for school-specific scholarships and aid.

Scholarships and Grants at Surana Evening College

At Surana Evening College, we offer a range of scholarships and grants to support our students. These include:

Merit-Based Scholarships: Awarded based on academic achievements, such as high GPAs or exceptional entrance exam scores.

Need-Based Grants: Provided to students who demonstrate financial need, helping to cover tuition and other expenses.

We also encourage students to explore external scholarship opportunities. Websites like College Board’s BigFuture and CollegeScholarships.org offer extensive databases of scholarships that can be filtered based on various criteria, including field of study and demographic factors.

Financial Planning Tools

Effective financial planning is crucial for managing your education costs. Here are some tools and tips to help you stay on track:

Budgeting Tools: Use financial planning calculators to create a budget that accounts for tuition, books, transportation, and living expenses. Websites like CollegeScholarships.org offer calculators for budgeting, loan consolidation, and savings planning.

Scholarship Search Engines: Utilize platforms that allow you to search for scholarships based on your profile. This can significantly increase your chances of finding relevant funding opportunities.

Financial Counseling: Take advantage of counseling services offered by the financial aid office at Surana Evening College. They can provide personalized advice and assistance in understanding your financial aid package and managing your finances.

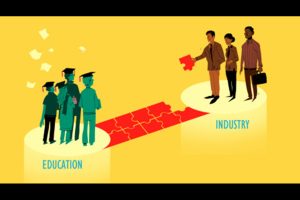

Benefits of Evening College Programs

Evening college programs, like those at Surana Evening College, offer several advantages for students who are working or have other daytime commitments:

Flexibility: Evening classes allow you to work during the day and attend classes in the evening, making it easier to balance work and study.

Accessibility: Online BCom and BCA programs offer the flexibility to study from anywhere, providing access to quality education without the need to commute.

By leveraging these resources and tools, students at Surana Evening College can effectively manage their educational expenses and focus on achieving their academic and career goals.